YOUR BUSINESS AUTHORITY

Springfield, MO

YOUR BUSINESS AUTHORITY

Springfield, MO

As a commercial, industrial and multifamily housing developer throughout the Northern and Midwestern United States, I have to watch economic trends for a wide range of industries and geographic regions.

Availability of affordable developed or developable real estate is crucial to local economic vitality to attract businesses and the employees who will support them. Springfield is falling behind on the affordable housing front. There simply are not enough habitations to support our workforce growth at a price at which they can keep rent at the recommended 30% of income.

The average fair market value rent for a two-bedroom apartment in the Springfield area is $746, according to a 2020 National Low Income Housing Coalition report. In order to cover rent and utilities, the renter’s hourly wage must be $14.35. However, the mean hourly wage for our area is $13.40, according to NLIHC. With an estimated 35%-43% of Springfield and Greene County residents renting, per census data, this is affecting a large portion of our employee base.

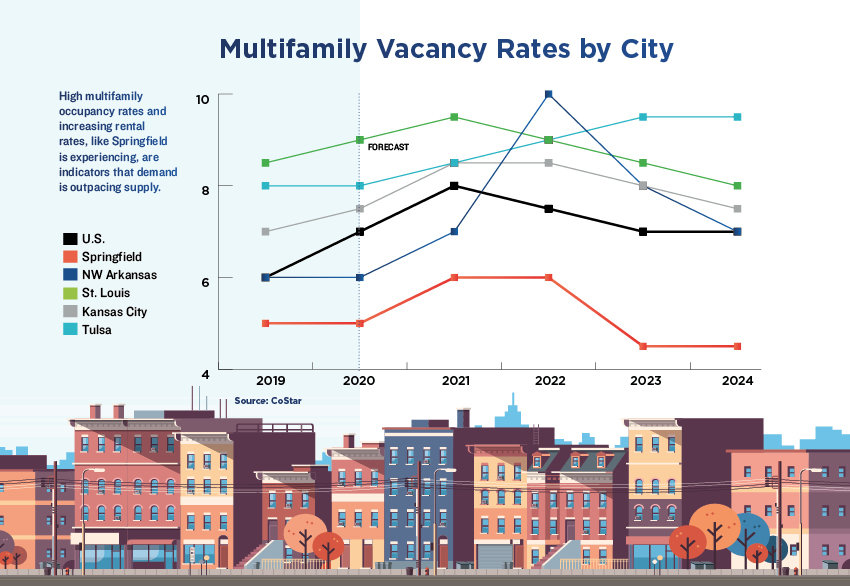

This disparity in affordability is the result of too few habitations and those of the right kind. Very simply, demand is higher than supply. This is great for me and other residential and multifamily landlords. I make more per rented unit. But it is bad for the vitality of ..our local economy and the financial well-being of our hourly workforce. Which, I believe, means it is ultimately going to result in the devaluing of my investments. So, really, nobody is winning.

I have a rule of thumb I use to determine what habitational supply needs to be in order to meet demand in a growing community like ours. Let’s assume you have population growth of 1,000 people per year. You have to house them in either multifamily or single-family homes. If you take those 1,000 new residents and divide by the number of people per household (1.5-2), the market needs 500 new units per year. If you assume a 50/50 ratio of single-family to multifamily units, the community needs 250 apartment units built per year.

While Springfield currently has three multifamily properties with 506 units under construction, only 72 of those units are likely to have rental rates at or below the average fair market value of $746. Our poverty rate is 24.8%, according to census data. We are falling behind in affordable housing.

This is not a problem that is easily solved. We are fortunate to have great, low-cost utilities as well as fantastic health care and educational systems. Those allow Springfield to be set up for a favorable lifestyle at a relatively low cost. However, you can’t backtrack to provide affordable housing. The key to solving the problem is multifaceted. On the supply side, we need to increase affordable housing construction incentives and develop new technologies to reduce the cost of construction. And on the demand side, we need to reduce the cost of staple goods and increase worker income.

Springfield is home to nearly 40,000 residents who are either at or below the poverty level. We only have 4,666 multifamily units that meet the CoStar 1 and 2 Star ratings and 13,234 in the 3 Star category, which would be considered affordable rental rates. Those units have a roughly 5% vacancy rate. A healthy vacancy rate is considered to be 10% to accommodate turnover of renters.

I am typically the most conservative person in any room. This is not a political issue. This is an economic issue and one we need to solve working together as employers, developers and policymakers so we can continue on our trajectory of growth, house the increasing number of workers and, ultimately, protect the investments each of us is making in Springfield.

Very simply, demand is higher than supply. This is great for me and other residential and multifamily landlords. I make more per rented unit. But it is bad for the vitality of our local economy and the financial well-being of our hourly workforce. Which, I believe, means it is ultimately going to result in the devaluing of my investments. So, really, nobody is winning.

Utah-based gourmet cookie chain Crumbl Cookies opened its first Springfield shop; interior design business Branson Upstaging LLC relocated; and Lauren Ashley Dance Center LLC added a second location.

Updated: Systematic Savings Bank to be acquired in $14M deal

Warby Parker store planned in Springfield

Former CoxHealth colleagues starting communications firm

Former Wentzville superintendent to get $1M in contract buyout

STL construction firm buys KC company

NPR editor resigns after writing piece critical of organization