YOUR BUSINESS AUTHORITY

Springfield, MO

YOUR BUSINESS AUTHORITY

Springfield, MO

More than 60% of Springfield’s general city budget depends on sales and use tax revenue. When businesses closed and people stopped spending during the COVID-19 pandemic, the city projected a revenue shortfall of 20 percent, or $2.3 million, for the remainder of fiscal 2020. Likewise, Greene County estimated a loss between $3.8 million and $5.2 million in sales tax revenue. The city’s approved fiscal 2021 budget is 6% – or $2.9 million – below the current year’s budget.

Fortunately, city Finance Director David Holtmann says the actual reduction in tax revenue for March and April was only 5%. He attributes that to income tax refund and stimulus check spending.

“But we’re still going to see a significant reduction for the next two months, finishing up this year,” he says. “Because at that point, that’s when we will see the impact of all the people that have lost their jobs and they were unable to work.”

Beyond impacting city operations, sales tax losses represent shortfalls for local businesses and their employees.

“Some have been closed for an extended period of time and people that work in those establishments, they did not have an income coming in, so that had a very negative effect on those entities,” Holtmann says.

That negative effect is reflected in lower business confidence according to Springfield Business Journal’s Economic Growth Survey. Conducted in April, it followed up a late February pre-coronavirus survey.

In the April survey, dubbed the Business Community State-of-the-Marketplace Assessment, 98% of respondents said they were very concerned about COVID-19 and the general economic impact it will have on national and local economies. That translated to a Business Confidence Index of 81.7, dropping from 142.8 reported in February.

Titus Williams, president of Prosperiti Partners LLC, thinks the index may have been even lower a few weeks later. In early April, the full impact was still unknown.

“The majority of people, I don’t think at that time, had a good grasp of how bad it potentially would get,” he says.

While the plight of small businesses dominates headlines, all sizes of companies expressed similar reduced confidence in the BCI: 81.1 (down nearly 64%) for both small companies with five or fewer employees and midsize firms with six to 50 employees; and 82.8 (down 61%) for large companies with over 50 employees. An index of 100 is a baseline confidence level.

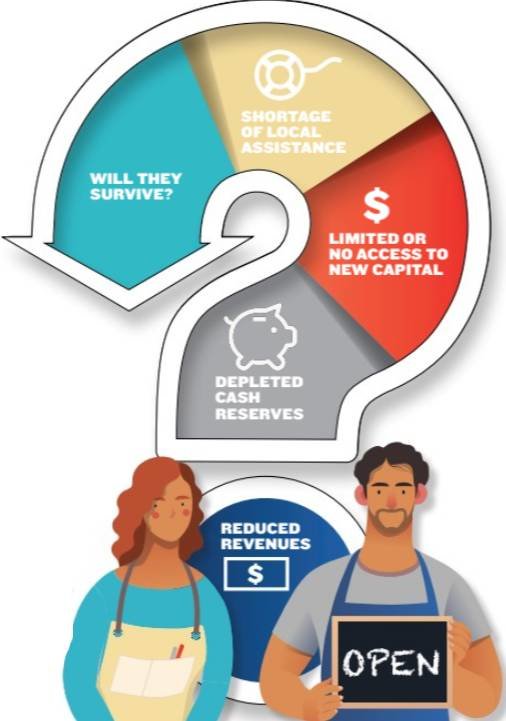

Economically, the hardest hit industries include hospitality, retail and restaurants, forcing many to pivot as they try to survive. But will they? With social distancing and fewer customers, the near impossibility to regain pre-coronavirus revenue is a concern for Williams.

“If you’re a small business, the lifeblood of your business is obviously the revenue. So, if you lose that revenue, even for a short period of time,” he says, “you deplete your savings, cash reserves and potentially inventory. And in the case of restaurants, when you come back online, it’s like you’re starting a new business.” Not only that, he says, “think about the amount of businesses that fail in the first two years.”

According to the U.S. Small Business Administration, only two-thirds of new businesses survive at least two years and about half survive the first five years. Potential losses could hurt future city programs and the local economy, Williams says.

In response to the widespread financial concerns among businesses, Congress has expanded the SBA Economic Injury Disaster Loan, which provides up to $100,000 to small businesses experiencing temporary revenue losses. Additionally, Williams recommends looking into other types of financing and investments, noting a shortage of local available assistance.

“As you can imagine, adding debt without an understanding of when things stabilize can make matters worse for most small businesses,” he says. “Unfortunately, our community doesn’t have many programs in place to assist struggling businesses.”

Even with those concerns, Williams says, Springfield is fortunate to have a strong, vibrant community with diversified industries. Some are thriving. In fact, Reeds Plumbing, HVAC and Excavating, recently acquired by Williams’ company, is busier than ever and hiring to meet the increased demand.

Springfield City Councilman Richard Ollis agrees.

“Whether that be tourism or manufacturing, we have strong health care, strong education, we are a retail hub – that diversity really helps us,” he says.

It also helps that the city has been fiscally conservative with strong cash balances, Ollis says. The General Fund is at approximately $81 million, according to city documents.

To offset shortfalls in the fiscal 2020 budget, Holtmann explains that in addition to cutting expenses, the city can use self-insurance cash reserves. Currently, those reserves are $28.8 million, of which $12.4 million is available as needed. There are other reserves, too – currently $17.2 million or about 20 percent of the General Fund – but if projections hold true for fiscal 2021, he says they shouldn’t be needed.

“We have been very careful and cautious with taxpayers’ money, and we have an excellent credit rating,” Holtmann says of the Aa1 rating by Moody’s Investors Service. “I’m really proud of where we are.”

In addition, Ollis says the city is on track to continue projects that will spur economic development, including the Missouri State University IDEA Commons development downtown, the Grant Avenue Parkway federal grant project and the Springfield Art Museum master plan. Officials also point to the investments of $170 million into Springfield Public Schools’ facility upgrades and $120 million into City Utilities’ fiber network expansion.

Projects like the Grant Avenue Parkway “will have a significant impact in the jobs that it brings, and the improvements that are made in helping Springfield become a better place,” Holtmann says. “So, from an economic vitality perspective, it’s a win-win.”

Williams agrees long-term city projects are important to help Springfield stay relevant in the future.

“Because the city has been fiscally conservative, we won’t have to pause long-range planning and development,” he says. “At the same time, we have to weigh those goals against focusing short-term attention on helping businesses and our residents get back to normalcy by creating internally managed business development grant or loan programs.

If businesses currently in operations start to fail and unemployment increases higher and faster than our peer communities, those long-term initiatives will take even longer to gain momentum.”

Connected to Watkins Elementary School is a new storm shelter now under construction.

Updated: Systematic Savings Bank to be acquired in $14M deal

STL construction firm buys KC company

Webster University's deficit triples

‘Dress for your day’: Companies are relaxing dress codes amid evolving ideas about fashion

Missouri House speaker accused of obstruction in ethics probe

Former CoxHealth colleagues starting communications firm

Developer targets opening by month's end for $10M apartment complex